Property Market Research & Insights

Welcome to the Australian Market Research Unit

your source for the latest news and in-depth analysis on Australia's dynamic property markets.

Housing Market Analysis - Ongoing tracking and reporting on national and regional market cycles, price changes, sales volumes, listing trends, and key drivers.

Suburb Profiles - Detailed pricing analysis, sales histories, development prospects, and demographic data for individual suburbs and micro-markets.

Buyer Profiles - Research into different buyer and investor segments, exploring their motivations, preferences and purchasing behaviour.

Rental Market Analysis - Data and insights on yields, vacant rates, tenant demand and rental price movements across different areas.

Mortgage Market Analysis - Research on lending conditions, mortgage rates, credit availability and affordability issues impacting buyers.

Commercial Property Analysis - Valuation data, yields, vacancy rates, tenant demand and future supply projections for retail, office and industrial sectors.

Special Topic Reports - Spotlight reports providing an in-depth look at key property issues like taxes, foreign investment, sustainability, rural markets etc.

Consumer Surveys - Polling home owners, buyers, renters and investors to gather perceptual insights into market sentiment and attitudes.

Latest News

Plant & Equipment Valuations in QLD: A Guide for SMEs

Small and medium-sized enterprises (SMEs) are the backbone of Queensland’s economy, spanning industries such as agriculture, mining, construction, and logistics. For these businesses, machinery and equipment often represent their most valuable assets. Knowing their true worth is crucial. Professional Plant and Equipment Valuations provide SMEs with independent, accurate assessments that support compliance, financing, and strategic growth.

Why SMEs in QLD Need Plant & Equipment Valuations

Supporting Finance and Investment

Banks and investors often require valuations before approving loans or capital funding. Independent reports provide confidence in the value of assets used as collateral.

Compliance and Legal Requirements

Accurate valuations are necessary for taxation, insurance, and audit obligations. For SMEs, this ensures transparency and protects against penalties or disputes.

Asset Management

Valuations help track depreciation and inform decisions about when to repair, replace, or upgrade critical equipment.

Key Benefits for Queensland SMEs

- Accurate Financial Reporting: Keeps balance sheets aligned with actual asset values

- Fair Insurance Coverage: Ensures machinery is neither under- nor over-insured

- Improved Negotiation Power: Supports fair transactions during asset sales or acquisitions

- Risk Reduction: Identifies underperforming or outdated assets

Industries That Rely on Valuations in QLD

- Agriculture: Assessing tractors, harvesters, and irrigation systems

- Mining & Resources: Valuing heavy machinery, vehicles, and processing equipment

- Construction: Cranes, excavators, loaders, and other project-critical assets

- Transport & Logistics: Valuations for fleets of trucks, trailers, and specialised vehicles

Choosing the Right Valuers in Queensland

When selecting valuation professionals, SMEs should look for:

- Accreditation and compliance with Australian standards

- Industry-specific expertise

- A track record of preparing defensible, detailed reports

Conclusion

For SMEs in Queensland, plant and equipment valuations are more than compliance — they are a foundation for smarter financial decisions, investment planning, and growth. By working with professional Plant and Equipment Valuations, businesses can protect their assets, plan strategically, and maintain financial transparency.

In industries where machinery drives productivity, accurate valuations are the key to resilience and long-term success.

Understanding Commercial Property Valuation: A Comprehensive Guide

Commercial property valuation is a critical process for businesses, investors, and financial institutions. Accurate valuations are essential for various purposes, including buying, selling, financing, and managing commercial real estate assets. This comprehensive guide will delve into the intricacies of commercial property valuation, its methods, factors affecting valuations, and why it is vital for businesses.

What is Commercial Property Valuation?

Commercial property valuation involves determining the value of a commercial property based on various factors. Unlike residential property valuation, which focuses on market value primarily influenced by comparable sales, commercial valuation considers a broader range of criteria, including income potential, location, and market conditions.

Methods of Commercial Property Valuation

There are several methods used to value commercial properties, each with its unique approach and application:

1. Income Capitalisation Approach

The income capitalisation approach is widely used for properties that generate rental income. It involves estimating the property’s net operating income (NOI) and capitalising it at an appropriate rate, known as the capitalisation rate (cap rate). The formula is:

Value = Net Operating Income / Capitalisation Rate

This method is particularly useful for properties like office buildings, shopping centres, and apartment complexes.

2. Sales Comparison Approach

The sales comparison approach, also known as the market approach, involves comparing the property with similar properties that have recently sold in the same area. Adjustments are made for differences in location, size, condition, and other relevant factors. This method is commonly used for both residential and commercial properties.

3. Cost Approach

The cost approach estimates the value of a property by calculating the cost to replace or reproduce it, minus any depreciation. This method is particularly useful for properties with unique features or those that are not frequently sold, such as special-purpose buildings. The formula is:

Value = Replacement Cost – Depreciation + Land Value

Factors Affecting Commercial Property Valuation

Several factors influence the valuation of commercial properties, including:

1. Location

Location is one of the most critical factors in commercial property valuation. Properties in prime locations with high foot traffic, accessibility, and proximity to amenities generally have higher values.

2. Market Conditions

Market conditions, including supply and demand, interest rates, and economic trends, play a significant role in determining property values. A thriving economy and low-interest rates typically boost property values, while economic downturns can have the opposite effect.

3. Property Condition

The physical condition of the property, including its age, construction quality, and maintenance, directly impacts its value. Well-maintained properties with modern amenities are valued higher than those requiring significant repairs or upgrades.

4. Income Potential

For income-generating properties, the potential to generate rental income is a crucial factor. Properties with high occupancy rates and long-term leases with creditworthy tenants are valued higher due to their stable income streams.

5. Zoning and Land Use Regulations

Zoning laws and land use regulations can affect the property’s potential uses and, consequently, its value. Properties with flexible zoning that allows for various uses typically have higher values.

The Importance of Accurate Commercial Property Valuations

Accurate commercial property valuations are essential for several reasons:

1. Investment Decisions

Investors rely on accurate valuations to make informed decisions about buying or selling commercial properties. Overvaluation or undervaluation can lead to significant financial losses.

2. Financing

Lenders require accurate valuations to determine the loan amount they can offer for a property. Overvalued properties may lead to higher loan amounts, increasing the risk for lenders, while undervalued properties may result in lower loan amounts for borrowers.

3. Tax Assessments

Accurate valuations ensure fair property tax assessments. Overvalued properties result in higher taxes, while undervalued properties may lead to lower tax revenues for local governments.

4. Business Planning

For businesses, accurate property valuations are crucial for strategic planning, budgeting, and financial reporting. They help in assessing the value of assets and making informed decisions about property management and expansion.

Conclusion

Commercial property valuation is a complex but essential process that involves various methods and factors. Understanding these elements helps businesses, investors, and financial institutions make informed decisions, ensuring financial stability and growth. By considering the location, market conditions, property condition, income potential, and zoning regulations, one can achieve a comprehensive and accurate valuation of commercial properties.

Whether you’re looking to buy, sell, or finance a commercial property, partnering with a qualified property valuer ensures that you have the most accurate and reliable valuation, tailored to your specific needs and goals.

Valuing a Fixer-Upper for Flipping Potential

Investing in a fixer-upper to flip for profit is an attractive strategy for many property investors. The key to success in such ventures lies in accurate fix and flip valuation. By estimating the after-repair value (ARV) of a property, investors can calculate the optimal purchase price to ensure a profitable return on investment. This article explores the crucial aspects of fixer-upper valuation and offers insights into making informed decisions when considering properties for renovation and resale.

Understanding Fixer-Upper Valuation

Fixer-upper valuation is the process of assessing a property’s current market value, considering the cost of necessary renovations, and estimating its potential market value post-renovation. This valuation is critical for investors looking to engage in the fix and flip market, as it helps determine the feasibility and profitability of a project.

1. Estimating After-Repair Value (ARV)

The ARV of a property is a projection of its market value after all renovation work has been completed. Accurately estimating ARV requires a thorough understanding of the property market, including current trends, buyer preferences, and the value added by specific types of renovations.

- Conduct market research: Analyse recent sales of comparable properties in the area to get a baseline for post-renovation values.

- Understand buyer preferences: Tailor your renovations to meet the demands and preferences of the target market to maximise the property’s appeal.

2. Calculating Renovation Costs

A detailed and realistic budget for renovation costs is crucial for fix and flip valuation. Underestimating these costs can erode profits, while overestimating can deter you from pursuing potentially profitable projects.

- Get multiple quotes: Obtain quotes from several contractors to ensure competitive pricing for renovation work.

- Factor in unexpected expenses: Always include a contingency budget for unforeseen costs, typically 10-20% of the total renovation budget.

- Consider time costs: Account for the holding costs during renovation, such as mortgage payments, utilities, and property taxes.

3. Determining the Optimal Purchase Price

With the ARV and renovation costs estimated, investors can calculate the maximum purchase price to offer for a fixer-upper. This calculation often follows the 70% rule in fix and flip investments, which suggests that investors should not pay more than 70% of the ARV minus renovation costs.

- Example calculation: If the ARV is estimated at $300,000 and renovation costs are $50,000, the maximum purchase price should be no more than $160,000 ($300,000 * 70% – $50,000) .

Key Considerations in Fixer-Upper Investments

Investing in fixer-uppers for flipping requires a careful balance between the cost of acquisition, renovation expenses, and the potential selling price. Here are additional factors to consider:

- Location: The value of real estate is heavily influenced by its location. Properties in desirable areas are likely to fetch higher ARVs.

- Market conditions: Keep an eye on market trends to predict future property values accurately.

- Renovation scope: Be realistic about the scale of renovations required and your ability to manage the project within budget and timeline constraints.

Valuing a fixer-upper for its flipping potential is a nuanced process that demands a deep understanding of the property market, renovation costs, and buyer preferences. By meticulously estimating the ARV and carefully planning the renovation budget, investors can navigate the fix and flip market with confidence, maximising their chances of a successful and profitable investment.

When to Get a Professional Valuation as an Investor

The Importance of Professional Property Valuation for Investors

For investors in the real estate market, obtaining a professional property valuation is not just a formality but a crucial step in various investment processes. Understanding when and why to seek these valuations can significantly impact investment strategies, risk management, and financial planning. This article explores key instances where property valuations for investors become essential.

Professional Valuation for Financing Purposes

One of the primary reasons investors seek professional property valuations is for financing. Whether it’s for acquiring a new property, refinancing existing loans, or securing additional funding, lenders often require an up-to-date valuation.

Loan-to-Value Ratio Calculation

Lenders use property valuations to determine the Loan-to-Value Ratio (LVR), which influences the terms and conditions of the loan, including interest rates and loan amount.

Refinancing and Equity Release

Professional valuations are also vital for investors looking to refinance their loans or release equity from their existing properties. An accurate valuation ensures optimal refinancing terms and maximises the equity available for withdrawal.

Valuation for Insurance Purposes

Property insurance is another critical area where professional valuations hold significant value. Accurate property valuation ensures appropriate insurance coverage, protecting investors from being underinsured or overpaying premiums.

Determining Replacement Costs

A key aspect of insurance valuations is assessing the property’s replacement cost, including costs associated with rebuilding and professional fees, in case of total loss.

Due Diligence in Property Investment

Conducting due diligence is a cornerstone of successful property investment. Professional property valuations are integral to this process, offering investors a clear picture of the property’s market value and potential.

- Market Analysis: Valuations provide an in-depth market analysis, helping investors understand current trends and potential growth.

- Risk Assessment: A professional valuation helps in identifying risks associated with the property, including market volatility and property-specific issues.

Property Valuations for Tax Purposes

For tax purposes, whether it’s for capital gains tax, property tax, or depreciation schedules, accurate valuations are essential. They ensure compliance with tax regulations and can lead to significant savings.

Capital Gains Tax Calculations

When selling a property, investors need to know its initial and final values to accurately calculate capital gains tax obligations.

Depreciation Schedules

Professional valuations also assist in preparing depreciation schedules for investment properties, maximising tax deductions related to property depreciation.

Australian House Price Factors

6 Factors That Impact House Prices

- Location

- Land Size

- Condition of the Property

- Market Conditions

- Age and Historical Value

- Extra Features

The property market can often feel like a rollercoaster ride, with house prices rising and falling based on a myriad of factors. Whether you’re looking to buy, sell or simply understand the value of your current home, knowing the key determinants of house prices is crucial. Here, we break down six primary factors that impact house prices in Australia observed by Melbourne realty agents.

1. Location

Arguably the most commonly cited factor, location profoundly impacts house prices.

Proximity to Amenities

Properties closer to the city centre, public transport hubs, schools, and shopping areas often command higher prices due to their convenience and desirability.

Neighbourhood Reputation

Areas renowned for safety, cleanliness, and community vibes can significantly up the price tag on homes.

2. Land Size

The saying “they’re not making any more land” rings especially true in the property market. The size of the land can directly impact house prices, with larger blocks often fetching higher prices, especially in urban areas where space is at a premium.

3. Condition of the Property

The state of the house itself plays a pivotal role in its valuation.

Maintenance and Upkeep

Homes that have been well-maintained, with recent renovations or updates, typically have a higher market value.

Structural Issues

Conversely, properties with structural problems, outdated interiors, or requiring significant repairs can see a dip in their prices.

4. Market Conditions

The broader economic environment and housing market trends can sway house prices.

- Supply and Demand: When more people are looking to buy than sell, prices tend to rise, and vice versa.

- Interest Rates: Lower interest rates can increase borrowing capacity, often pushing up property prices.

- Economic Factors: Employment rates, economic growth, and consumer confidence can all influence house prices.

5. Age and Historical Value

Older homes, especially those with historical significance or unique architectural features, can command higher prices. However, very old properties without modern updates or with potential structural issues might face price reductions.

6. Extra Features

Additional features can add substantial value to a property. Swimming pools, extensive landscaping, solar panels, or smart home integrations can all positively impact house prices, depending on the preferences of potential buyers and the local market demand.

Understanding the Factors that Shape the Market

While these six factors are among the most influential in determining property prices, it’s essential to remember that the market is fluid. Trends shift, and what’s deemed valuable now might change in the future. However, by understanding the fundamental factors that impact house prices, you’ll be better equipped to make informed decisions in the property world.

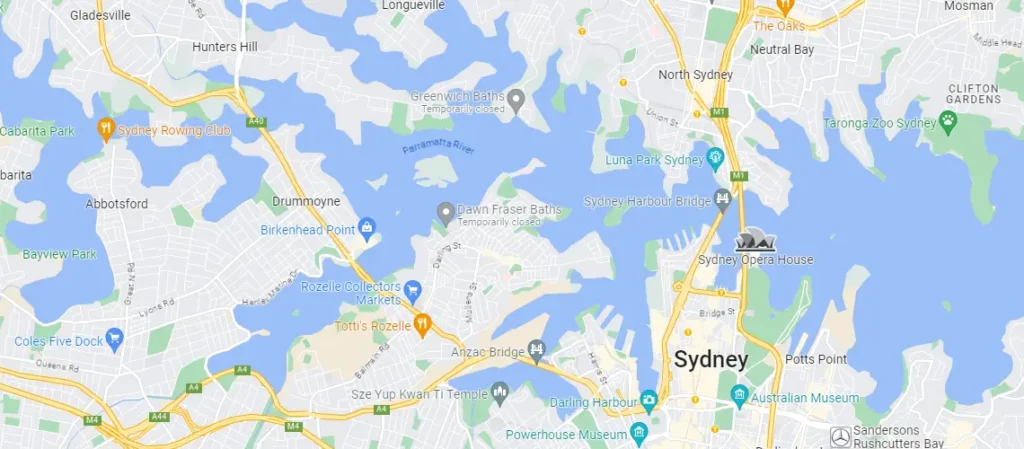

Sydney Property Value Trends Over the Past Decade

Sydney’s property market has seen significant growth and fluctuation over the past 10 years. While some areas have skyrocketed in value, others have remained relatively stable or even declined. Understanding Sydney property value trends by area can help buyers and investors make informed decisions. We’ve enlisted help from certified Sydney property valuers to gather the most up-to-date information.

Inner City Suburbs See Strong Growth

Suburbs within 5-10km of the CBD like Surry Hills, Redfern, and Waterloo have seen enormous growth in property values over the past decade.

Redfern’s median house price has risen from $750,000 in 2012 to over $1.5 million in 2022 – a 100% increase. Terrace houses that sold for $900,000 in 2013 are now fetching over $1.8 million. This rapid growth has been fuelled by Redfern’s transformation into a trendy inner-city hub, attractivity for young professionals, and its proximity to the Sydney CBD.

Surry Hills has seen similarly dramatic growth, with its median unit price rising from $562,000 in 2012 to $980,000 in 2022. ten tears ago, buyers could still find apartments in Surry Hills for under $400,000. Today most sell for $800,000+.

Overall, most inner city suburbs within 5km of the Sydney CBD have doubled or even tripled in value over the past 10 years. Their popularity among young professionals and ease of commute has driven huge demand.

Middle Ring Suburbs More Stable

Middle ring suburbs 10-20km from the Sydney CBD like Hornsby, Chatswood, and Parramatta have seen steadier, more sustainable growth over the past decade.

Hornsby’s median house price has risen 65% from $740,000 in 2012 to $1.22 million in 2022. Chatswood units have gone from a median of $470,000 in 2013 to $740,000 in 2022 – a 55% increase over a decade.

These middle ring suburbs remain popular with young families looking for more space and access to amenities like schools, parks and transport. However their growth has been more modest compared to inner city postcodes.

Western Sydney Still Affordable

Sydney’s Greater Western suburbs like Blacktown, Mt Druitt and Penrith remain relatively affordable compared to the Inner West and North Shore.

Blacktown’s median house price is currently $900,000 – up 50% from $600,000 in 2012. Units in Mt Druitt can still be purchased for under $400,000. Penrith has seen steady growth from a 2012 median house price of $387,000 to $630,000 in 2022.

While values have risen, these Western Sydney suburbs continue to offer homeowners and investors relative affordability compared to middle and inner city areas. Their transport links and growing amenities make them increasingly attractive.

Weighing Up the Pros and Cons of Online vs In-Person Valuations

Getting a property valuation is crucial when buying or selling a home. But should you go for the convenience of an online valuation or invest time in an in-person inspection and appraisal? Here we examine the key pros and cons of each approach.

Online Property Valuations

Online valuations use property data and algorithms to estimate a property’s value without visiting the site.

Pros

- Fast and convenient – get an indicative value instantly online

- Low cost – online valuations are usually free or low cost

- Help guide expectations – useful for preliminary price research

Cons

- Less accurate – lacks local on-site inspection of property features

- Automated – lacks human judgement and analysis

- Can’t assess renovations/improvements – relies on basic property data

In-Person Valuations

A qualified local valuer will physically inspect your property and surrounding comparables.

Pros

- Highly accurate valuation – inspects all details of property live

- Local expertise – draws on in-depth area knowledge

- Assesses renovations – factors work/improvements into valuation

- Experienced judgement – sophisticated valuation analysis

Cons

- More time intensive – requires appointment and property visit

- Higher cost – expect to pay $200-$400+ for valuation

- Availability – may need to book well in advance

Which is Best?

For a preliminary estimate, online valuations offer speed and convenience. But for an official valuation when transacting, an in-person inspection delivers greater accuracy, insight and confidence.

While more intensive, a human valuer can best assess the true value of your unique property based on first-hand analysis. This is strongly advised before committing to any final real estate decision.

In summary, online valuation tools serve an early guidance purpose well, but when it comes time to sell or buy, invest in a professional in-person valuation for reliable accuracy.

Melbourne House Price Trends and Forecasts

The Melbourne property market has seen strong growth over the past decade, with house prices more than doubling between 2012 and late 2021. However, the market has cooled slightly in 2022 as rising interest rates and cost-of-living pressures curb buyer demand.

Examining Historical Melbourne House Prices

According to CoreLogic home value data, Melbourne’s median house price has grown from $407,000 in 2012 to a peak of $916,000 in December 2021 – an increase of 125% over the decade.

Over the past 5 years (2017 to 2021), Melbourne house values grew by a robust annual rate of 5.4% per annum. This was largely driven by low interest rates, strong population growth, and undersupply in the market.

Key Drivers of Strong Growth Phase

- Low interest rates – The RBA cut rates to record lows of 0.1% during COVID, improving affordability. This motivated buyers to borrow more.

- Population growth – Melbourne saw rapid population growth pre-COVID, creating housing demand. Net overseas migration added over 110,000 people in 2018/19.

- Undersupply – Dwelling construction couldn’t keep pace with population growth. This mismatch between supply and demand put upwards pressure on prices.

However, these dynamics have shifted in 2022. Interest rates are rising quickly, overseas migration remains low, and affordability is decreasing. This has slowed the housing market.

Forecasting Future Melbourne House Price Changes

The growth phase has ended and forecasts suggest a gradual decline in values over 2023 and 2024. However, the market is expected to stabilise and recover in 2025.

2023 – Prices forecast to fall 6 to 10% as higher rates continue to dampen demand and cost-of-living pressures limit spending power.

2024 – A further 5 to 8% decline possible as economic headwinds remain. Immigration may pick up slightly.

2025 onwards – The market likely to stabilise and record modest growth thanks to improving affordability and more normal economic conditions.

Overall, while Melbourne house prices may correct 10-15% from late 2021 highs, the medium-term outlook remains positive. Population growth will pick up again and drive underlying demand. But growth trends are set to moderate from the strong gains recorded over the past decade.

Technology Trends Changing Commercial Valuations

The commercial property landscape in Australia is undergoing a transformation. Rapid advancements in technology are impacting property valuations and the metrics used to determine commercial property worth. As technology evolves, valuation approaches must adapt to account for emerging trends.

The Rise of Prop-tech

One of the biggest factors influencing commercial valuations is the growth of prop-tech, or property technology. Prop-tech refers to software, analytics, platforms, and other technological tools applied to the property sector. These innovations are streamlining how properties are designed, valued, bought and sold.

Prop-tech tools such as building information modelling (BIM), augmented reality (AR), and virtual reality (VR) are being used to create digital twins of buildings. These 3D virtual models provide far more data about a property’s specifications and can lead to more accurate valuations. Big data analytics leveraging AI and machine learning are also being used to uncover insights from property data to optimise valuations.

Automation and Remote Working

Advances in automation and increased remote working are also impacting property valuations. With more tasks being automated, commercial tenants need less space for employees and administrative functions. Distributed workforces working from home also reduce the need for office space.

These trends lower demand for traditional office setups, which can negatively impact valuations. However, increased flexibility and lower overheads provided by automated processes can make properties more appealing to tenants. Valuations must weigh these pros and cons.

Sustainability Metrics

Sustainability is becoming a priority for commercial tenants, so green building certifications and energy efficiency metrics are influencing valuations. Technologies like smart lighting, HVAC, and energy monitoring play a key role in reducing a building’s environmental impact.

Valuers are increasingly accounting for sustainability features and certifications like Green Star and NABERS ratings when assessing a property’s value. More weight is placed on futureproofing through eco-friendly design, construction and operation.